Trump Tariffs Impact UK Exports, Causing Quick Decline in Overseas Demand

Sales of British goods to international markets fell at the fastest rate in nearly five years during April, as foreign companies reduced their purchases due to tariffs imposed by President Trump, according to a recent survey released on Thursday.

The final S&P Global manufacturing purchasing managers’ index (PMI) for the UK increased to 45.4 in April, up from 44.9 in March.

This figure was significantly adjusted upward from the initial estimate of 44 but still remained below the pivotal 50-point mark, indicating contraction. Analysts had anticipated that the final reading would match the earlier estimate.

Despite the improvement, the survey indicated that Trump’s tariffs and the ensuing uncertainty about global trade negatively affected the demand for British exports.

Rob Dobson, director at S&P Global Market Intelligence, stated: “New export business decreased at the fastest pace in nearly five years, with demand falling from clients in the US, Europe, and mainland China.”

“Manufacturers reported that the announcements regarding US tariffs are having a significant impact on global markets as trade partners adjust to increased volatility in trade,” he added.

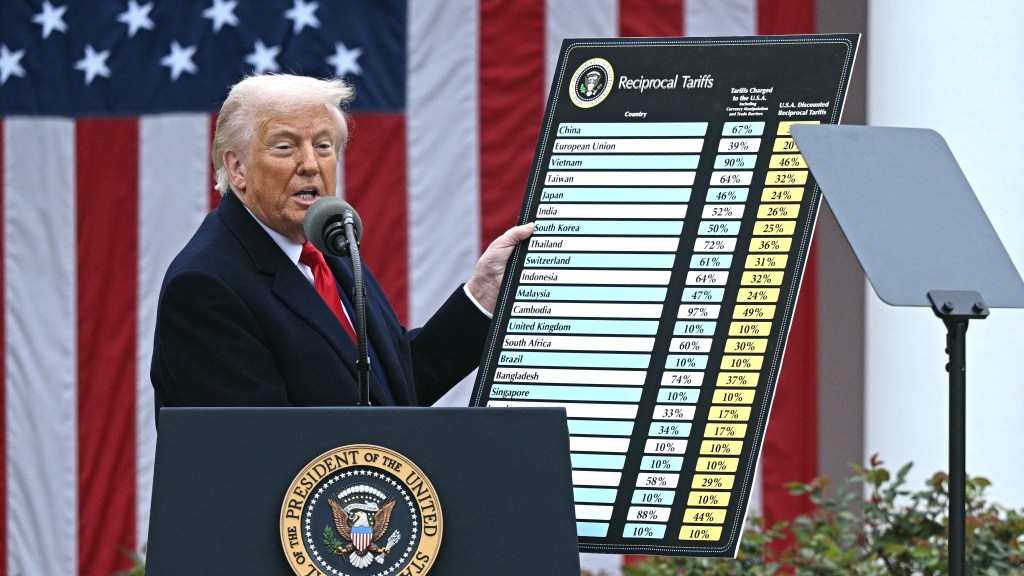

On April 2, Trump unveiled his plan for reciprocal tariffs, which would escalate the effective US tariff to the highest level in over a century. While implementation has been postponed until July, a baseline 10% charge on all imports remains in effect, along with a 145% tax on Chinese goods and specific tariffs on categories such as cars and metals. The US administration has expressed willingness to discuss reducing tariffs for certain countries.

Elliott Jordan-Doak, a senior UK economist at Pantheon Macroeconomics, commented: “We anticipate that activity in the manufacturing sector will stay weak for an extended period. The Bank of England is likely to lower interest rates further — we predict three additional cuts of 25 basis points this year — which should provide some support to manufacturing.”

“However, global manufacturing has faced significant challenges due to rising trade tensions. Additionally, Trump’s focus on tangible goods over services suggests that uncertainty regarding trade policy will likely persist, affecting manufacturing sentiment more heavily than other sectors,” he noted.

Recent GDP data from the Office for National Statistics revealed that the UK economy grew by 0.5% in February, surpassing expectations. Nevertheless, the International Monetary Fund recently revised its growth forecast for 2025 down to 1.1% from 1.6%.

The Bank of England is expected to announce a 0.25 percentage point reduction in interest rates next Thursday, lowering them from 4.5% to 4.25%, marking the fourth cut since August.

Decline in Consumer Confidence

Consumer confidence experienced its steepest decline since the onset of the Covid-19 pandemic in the last month, as households reacted to the global economic instability stemming from President Trump’s tariffs, according to a new survey.

The YouGov consumer confidence index dropped by 4.6 points in April, resulting in a level of 107.1, marking the largest monthly decrease since April 2020 when the UK was initiating a nationwide lockdown to mitigate the pandemic.

Despite the downturn, the index remained above the neutral threshold of 100, suggesting that a majority of households still maintained a positive outlook during the month.

Will Ullstein, UK chief executive of YouGov, remarked: “In April, households have faced numerous challenges both domestically, with rising bills, and from major global economic developments related to tariffs. This has led to the most significant monthly decline in consumer confidence since April 2020, coinciding with the first full month of the lockdown.”

Post Comment